The Ultimate Guide to GST Compliance for Pet Stores

Are you struggling to manage your pet store’s GST compliance? It can be tricky, right? Many pet store owners face challenges when it comes to managing GST invoicing, from correctly applying tax rates to ensuring that their invoices match the required format. Don’t worry! With the right tools and guidance, you can simplify this process and avoid costly mistakes. Now, we will discuss how Just Billing POS can make GST compliance easy for pet store owners by automating invoicing, ensuring accurate calculations, and streamlining the filing process.

What is GST and Why Does It Matter for Pet Stores?

Goods and Services Tax (GST) is a comprehensive tax system implemented by the government in India to replace various indirect taxes. It applies to all businesses, including retail businesses like pet stores, and is divided into different tax slabs based on the products and services offered.

For pet stores, it’s essential to understand the different GST categories for pet products. Pet food, toys, accessories, and services (like grooming) may fall under different GST tax rates. Some items may be taxed at a lower rate, while others might be taxed higher. If pet store owners fail to categorize their products correctly, they could face compliance issues and fines from tax authorities. Therefore, accurate invoicing is key to ensuring that you are charging the correct GST rate for each product and service.

Common GST Invoicing Mistakes Pet Stores Make

One of the most common errors pet store owners make is applying incorrect tax rates. Pet products can fall under different GST categories, and mistakenly applying the wrong tax rate can lead to non-compliance. Additionally, mismatched item descriptions or failing to provide the proper details on the invoice can cause problems during audits.

These mistakes can lead to big financial problems. Wrong GST invoicing may cause heavy fines, penalties, and legal trouble. It can also hurt your store’s reputation and create extra stress and work. That’s why it’s important to have a system that handles GST invoicing correctly and consistently.

How Just Billing Can Help You Achieve GST Compliance

This is where Just Billing software steps in. Just Billing offers a range of features specifically designed to help pet stores with GST compliance. Here’s how it can make your life easier:

- Automatic Tax Calculations: Just Billing POS automatically calculates the correct GST for each product or service, ensuring that your invoices are always accurate.

- GST-Compliant Invoice Templates: The POS software provides GST-compliant invoice templates, so you don’t have to worry about formatting issues. Just select the right products, and the software will do the rest.

- Simplified Filing: Just Billing generates detailed reports that make it easy to file your GST returns, reducing the chances of errors and ensuring that your returns are accurate.

- GST Rate Setup: With Just Billing, you can easily set up the correct GST rates for your inventory. The software will remember the tax rate for each product, so you don’t have to worry about manually entering it each time you issue an invoice.

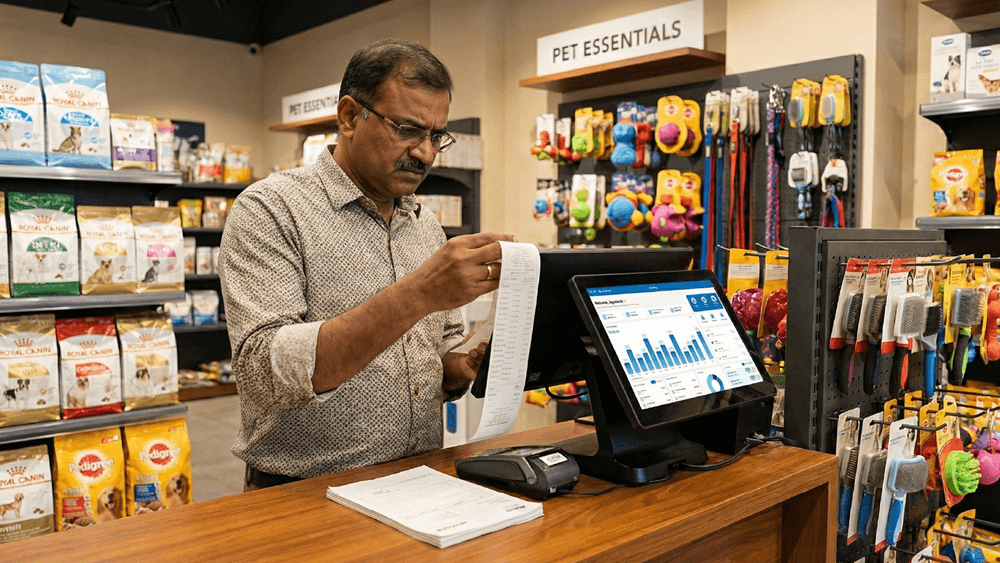

By automating your GST invoicing with Just Billing POS, you’ll save time, reduce mistakes, and improve overall compliance with GST regulations.

Step-by-Step Process for Managing GST Invoicing with Just Billing

Getting started with Just Billing for GST invoicing is simple. Here’s a step-by-step guide on how to manage GST invoicing for your pet store:

- Set Up GST Rates in Just Billing: First, input the correct GST rates for the different pet products you sell. You can do this by creating tax categories for items like pet food, accessories, toys, and services. This ensures that each product or service is assigned the correct tax rate.

- Generate GST Reports: At the end of the month or quarter, Just Billing allows you to generate reports that summarize your GST transactions. These reports can be directly used for filing your GST returns, saving you time and effort.

- File GST Returns: With accurate reports from Just Billing, filing your GST returns is a breeze. Just Billing helps ensure that the tax amounts are calculated correctly, reducing the chances of errors in your returns.

Benefits of Using Just Billing for GST Compliance in Pet Stores

Using Just Billing POS for GST invoicing comes with several advantages that make managing your pet store’s compliance easier:

- Streamlined Invoicing and Tax Management: Just Billing automates many of the tasks involved in creating GST-compliant invoices, so you can focus more on your business. With the right tax rates set up, you no longer have to worry about manually applying them to every invoice.

- Increased Efficiency: By eliminating the need for manual calculations and tax adjustments, Just Billing POS reduces the time you spend on administrative tasks. This allows you to focus on growing your pet store business.

- Reduced Risk of Audits and Penalties: With accurate, automated GST invoicing, your chances of facing a GST audit or penalties are much lower. Just Billing ensures that your invoices and tax filings are always in line with government requirements.

- Peace of Mind: Just Billing helps you stay compliant with minimal effort. Knowing that your GST invoicing and reporting are handled accurately gives you peace of mind, so you can focus on what matters most – running your pet store.

Conclusion:

Managing GST compliance doesn’t have to be complicated for pet store owners. By using Just Billing POS software, you can simplify your invoicing, reduce errors, and ensure that your business remains compliant with GST regulations. The automated features of Just Billing save you time and effort while helping you avoid the financial consequences of mistakes.

If you’re ready for a hassle-free GST experience, try Just Billing POS today and take control of your invoicing and tax management with ease!

Search for article

Popular Posts

Download Our App

Share the Post

Retail Billing Software

Super market, Grocery, Electronics, Gift Shops & Stationery

Restaurant Billing Software

Take away, Self service, Ice cream parlor, Coffee shop, Bakery

POS for Service Business

Accountant, Lawyer, Consultant, Photographer

Join Our Newsletter

Receive the latest blog posts, industry insights & exclusive Just Billing updates directly to your inbox.