Why Accurate Tax Reporting is Crucial for Restaurants and QSRs

Managing a restaurant is a balancing act. You deal with recipes, customers, staff schedules, and food costs every day. But there’s one thing which is crucial and that quietly runs in the background—and if ignored, it can create serious trouble that is tax reporting.

Many restaurant owners don’t focus enough on tax accuracy. But in reality, this could be the difference between growing your business or facing legal issues. This is where Restaurant POS comes into play which makes it easier. Let’s explore why tax accuracy matters so much in the restaurant business.

Why Tax Accuracy Often Gets Overlooked in the Food Business?

Understanding Restaurant Taxes

Understanding taxes isn’t fun—but it’s necessary. Here are the common taxes restaurant businesses must deal with:

- Sales Tax: Collected from customers and paid to the government. The rate can different based on location and the nature of the sale.

- Payroll Tax: Involves withholding taxes from employee wages and contributing the employer’s share.

- Income Tax: Based on the restaurant’s net income, requiring accurate reporting of all revenues and expenses.

- Property Tax: Charged on the restaurant’s property, and the amount depends on the location.

- Excise Tax: Applicable to specific goods like alcohol and tobacco, often requiring additional licensing and reporting.

Why Taxes in Food Service Are More Complex Than Other Industries

Unlike retail or service-based businesses, food establishments handle cash, card, online orders, dine-in, takeaway, and delivery—all with different tax implications. For example:

- Dine-in meals might be taxed at one rate.

- Takeaway or parcel orders could attract a different rate or exemption.

- Delivery services often deal with multiple state tax rules depending on the location of the customer

What Happens When Tax Reporting Goes Wrong

💣 Big Fines & Penalties

Failing to report correctly or missing deadlines can lead to heavy financial losses.

🕵️ Government Audits

Incorrect filings raise red flags, and you could be audited. That’s a huge drain on time and resources.

📉 Loss of Trust

A tax scandal can ruin your reputation with investors, partners, and even loyal customers.

Real - Example

A small café didn’t report its delivery sales correctly for six months, thinking the platform charges were not taxable. This mistake led to a tax audit and a fine of over ₹2 lakhs—more than what they earned in a month.

How Accurate Reporting Supports Business Growth

- Makes Financial Planning and Forecasting Easier

Accurate tax reporting provides a clear picture of your restaurant’s financial health, allowing better budgeting and forecasting. It makes you identify trends, manage expenses, and plan for future growth with confidence. - Builds Investor and Stakeholder Trust

Investors and partners depend on clear financial records to make smart decisions. When your tax reports are accurate, it shows that your restaurant follows rules and handles money responsibly, which builds trust and attracts more support. - Helps Maintain Compliance and Avoid Future Issues

Regular and accurate tax reporting ensures compliance with tax laws, reducing the risk of audits and penalties. It also makes it easier for handling any future tax-related inquiries or rule changes

The Role of POS Systems in Tax Accuracy

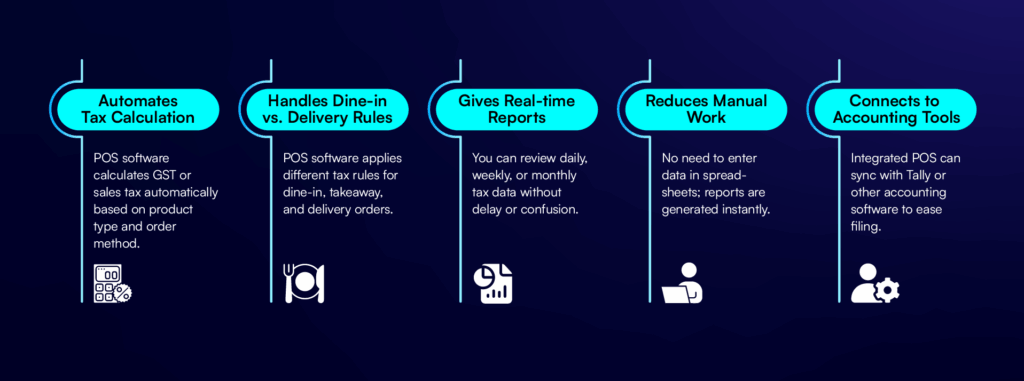

- Automates tax calculation

The POS software calculates GST or sales tax automatically based on product type and order method. - Reduces manual work

No need to enter data in spreadsheets; reports are generated instantly. - Handles dine-in vs. delivery rules

POS software applies different tax rules for dine-in, takeaway, and delivery orders. - Connects to accounting tools

Integrated POS can sync with Tally or other accounting software to ease filing. - Gives real-time reports

You can review daily, weekly, or monthly tax data without delay or confusion.

Conclusion:

Accurate tax reporting is not just a regulatory requirement; it’s crucial for successful restaurant business. By understanding the complexities of restaurant taxes, using modern POS systems, and maintaining diligent records, you can ensure compliance, build trust with stakeholders, and show the way for sustainable growth.

This is where Just Billing Restaurant POS Software can make a real difference. It automates tax calculations for every transaction, ensuring accuracy and saving you time. The POS software also generates detailed tax reports and integrates smoothly with accounting systems, making your tax filing easier and error-free.

By using Just Billing, restaurant owners can focus more on serving great food and less on worrying about taxes. It builds trust with investors and helps maintain compliance with tax authorities. Finally Just Billing helps you stay ahead of taxes, not behind them — so your restaurant can grow without the stress of tax troubles.

Search for article

Popular Posts

Download Our App

Share the Post

Retail Billing Software

Super market, Grocery, Electronics, Gift Shops & Stationery

Restaurant Billing Software

Take away, Self service, Ice cream parlor, Coffee shop, Bakery

POS for Service Business

Accountant, Lawyer, Consultant, Photographer

Join Our Newsletter

Receive the latest blog posts, industry insights & exclusive Just Billing updates directly to your inbox.